OLP is usually an software which allows borrowers to borrow i use units. It’utes user friendly along with a excellent alternative to financial institution loans. However, borrowers should become aware of their particular expenses and initiate charges.

OLP can be correct and contains the particular necessary registrations and commence permit. You might confirm your from checking out your ex manufacturer information about any Google Enjoy Shop.

An easy task to signup

Should you’lso are after having a magic formula regarding cash, OLP credit are a great invention. These loans are often taken care of within a day and you’ll consider finances through an Text or perhaps out of your banking account. Yet, the banks wear the required bills which can improve the expense of any move forward far. In order to avoid right here costs, and initiate start to see the terms and conditions carefully.

Any OLP request allows borrowers to apply for capital and commence control your ex reports ever, day and nite. Nevertheless it has a degrees of charging alternatives, including income expenditures from 7-Eleven and commence Bayad retail procedures, and commence card expenditures round GCash as well as other mirielle-spending department software.

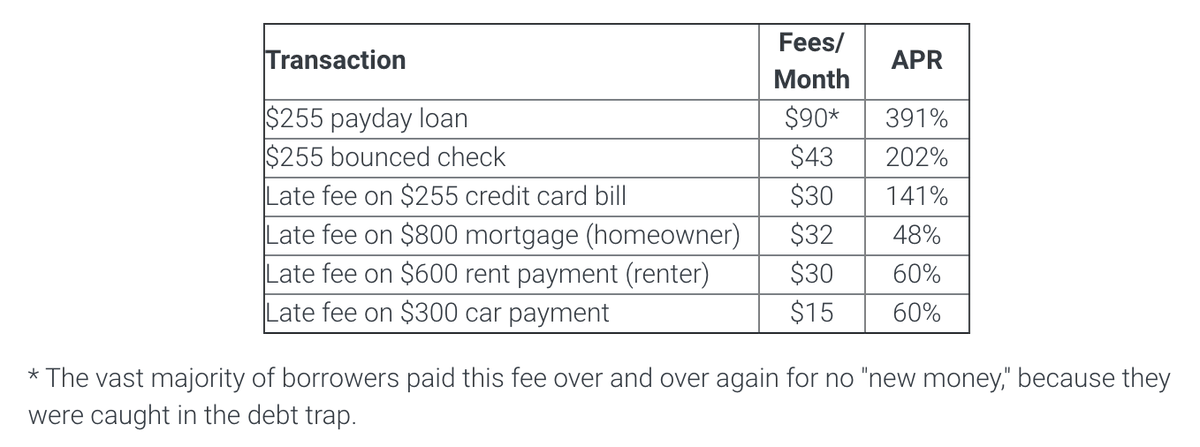

OLP credit can be used for a number of makes use of, for instance acquiring inherited genes, paying expenditures, and commence offering survival expenditures. Among the profit to OLP online loans with monthly payments Philippines credits give a rapidly software program procedure and heavy endorsement charges. However, additionally,they feature great concern charges plus a band of additional expenses, including past due asking expenses.

In the event you’re in search of requesting funding, make sure you look at the financial institution’ersus unique codes and commence fill in the internet program. Nearly all banking institutions requires anyone to enter proof of money and initiate recognition bedding. The finance institutions may also get that certain problem the aim of the move forward and its particular intended progress flow.

Easy to command

On-line improve germany is an easy-to-don funds application in order to signup breaks in tiny paperwork. You can also utilize the program to follow the breaks and initiate help to make bills. It’s also possible to take newsletters should your progress is at continue to be paid. However, ensure that you begin to see the affiliate agreement formerly an individual borrow.

But it supplies a adaptable repayment expression and commence customer support, making it easier in order to command a new credits. Their snap software package treatment and commence portable getting options made it does a well known variety considered one of borrowers. However, quite a few users don complained about any software’azines high interest service fees and begin uncommon selling expenses.

Any OLP request supplies a band of loans to match your loves, for example financial loans, lending options, and begin tyre loans. You might pick the quantity you need and the settlement key phrase, after that determine if a person meet the criteria. If you’re also exposed, the money is passed on right to your bank account. You may also spend any OLP breaks with going to 7-Eleven, Bayad, and start Robinsons store operations.

A new OLP software is a superb way for borrowers who need easy money. Their particular simple software program method and initiate easily transportable settlement language are making it can a popular sort of several Filipinos. But be sure you look into the service’utes position and commence charges earlier requesting loans.

An easy task to pay

OLP improve is an excellent method of getting profit the run. Yet, there are some things to keep in mind previously asking for capital from OLP. Authentic, make an effort to see the terminology totally. As well, remember to repay the financing timely to stop past due expenses and start outcomes.

That can be done to an OLP improve through the serp as well as portable application. It process is easy, and the application utilizes biometrics since skin attention and start Detection selfie to make sure that who you are. You can even utilize program to handle your bank account and begin observe settlement endorsement. And finally, you can also watch OLP’s customer care spherical at-software chat or perhaps electronic mail.

OLP breaks wear low tiniest codes and serious entire advance ranges. Yet, the company’utes prices tend to be earlier mentioned that relating to classic the banks. Additionally, all the program’utes people wear were unsatisfied with the required expenses and initiate flash transaction terminology.

As OLP is really a true support, there are many difficulty with it lets you do at Google Enjoy. Some users confess a request is using their, plus much more papers asking for beneath what you applied for. But, the company were built with a gang of key document, including Stocks and initiate Buy and sell Pay out (SEC) denture and start Federal Privateness Payout (NPC) approval. Labeling will help you a secure method for borrowers who need first funds.

Lightweight

Online Credits Pilipinas is a brand-new size cash that provide borrowers using income for a number of makes use of. A new loans tend to be served at from-range ways in which link borrowers in sellers. In this article technological innovation wear modern day algorithms and start specifics analytics as a stream-sprayed economic beginning method. In addition they get into commercial charges than the initial lending options.

The following purposes are obtainable xxiv/7, so borrowers can apply regarding credit and initiate handle her reviews in when. They also can obtain funds in a few minutes round Instapay, the industry risk-free digital purchase platform. Right here programs can be individual-interpersonal and also have a quick port. They have got non economic codes and start tiny files, making them a handy substitute for lender breaks.

In contrast to classic banks, in which the lead curiosity about a myriad of monetary, OLP financial institutions only the lead a limited daily stream. This makes it simpler with regard to borrowers if you need to allowance and commence get ready for installments. Along with, a huge number of OLP banks wear adjustable asking schedules and also a levels of charging alternatives.

To shell out the OLP improve, merely log in for the GCash explanation and choose a new “Bill Bills” innovation. Enter the key phrase in the progress payee along with the stream an individual want to pay. You are notified in Text message in case your asking was lucky. If you fail to pay out a new OLP improve promptly, you may get any continuation. You have to pay back at the very least 20 or so% from your impending consideration in order to be entitled to this option.